property tax consultant license texas

Certificate emailed immediately upon completion. Texas Real Estate Broker License 0285839.

Property Tax Funding Better Business Bureau Profile

Only Texas requires a license to become a property tax consultant.

. This course meets all TDLR requirements for Property Tax Consultants to renew their license in Texas. In that state 40 hours of classroom instruction is required unless applicants have related documented experience. This range is not provided by Ryan it is based on 4 Linkedin member-reported salaries for Property Tax Consultant at Ryan in Houston Texas United States.

When acting as a Property Tax Consultant andor a Real Estate Broker he is not acting as an Appraiser. Box 12157 - Austin Texas 78711-2157 800 803-9202 - 512 463-6599 - FAX 512 475-2871 wwwtdlrtexasgov - cspropertytaxconsultantstdlrtexasgov APPLICATION FOR. 2 be a member of a nonprofit and voluntary trade association.

This course covers Ethics Property Tax Consulting Best Practices Appraisals and Texas Laws and Rules. Temporary Disaster Exemption Texas Winter Storm 2021. Texas Department of Licensing and Regulation Property Tax Consultants PO Box 12157 Austin TX 78711 800 803-9202 in state only 512 463-6599.

If you are already licensed then please apply. Texas Senior Property Tax Consultant License 2797. AllSet Continuing Education AllSet CE is designed to provide Texas continuing education courses over the internet web base to everybody.

Hirschy MAI CCIM is highly educated in valuation work. Twelve 12 Continuing Education hours are required each year. Property Tax Consultants are licensed and regulated by the Texas Department of Licensing and Regulation.

A whose membership consists primarily of persons who perform property tax consulting services in this state or who engage in property tax management in. Texas law requires hours of continuing education for every license renewal. Fundamentals of Mass Appraisal.

Reliance Staffing Inc - Irving TX. SENIOR PROPERTY TAX CONSULTANT PURSUANT TO OCCUPATIONS CODE CHAPTER 1152 TITLE 7 PRACTICES AND PROFESSIONS RELATED TO REAL PROPERTY AND HOUSING. The course covers tax appraisal guidelines and requirements as well as best practices and useful business information.

Certificate emailed immediately upon completion. LICENSE - Check YES or NO to indicate if you are currently licensed as a real estate broker salesperson or appraiser. 9421 8 A iii II d no less than 24 hours in the theory and practice of appraisal of real property.

Finish in less than 24 hours. For more information about Property Tax Consultants contact customer service. 9421 8 A iv II c no less than 18 hours in mass appraisal.

Accordingly the Comptrollers office has approved the following examinations administered by the Texas Department of Licensing and Regulation TDLR. Texas Protax is your trusted consultant for property tax reduction. If YES provide your real estate license type number and expiration date.

Finish in less than 24 hours. Certificate emailed immediately upon completion. Forty 40 hours of pre-licensing education is required for first time registrants and the successful passing of an examination administered through PSI the testing agency.

With our Texas Continuing Education course youre on the right path. Texas Laws and Rules are also covered. Our mission is to help you lower your property taxes.

Provide the name license numberbar number and signature of your sponsor. The course will satisfy the required continuing education you need to renew your license. For PROPERTY TAX consultants in Texas it is by the license renewal date every year.

TAPTP has established itself as the clear voice of unified property tax professionals and has prevailed in multiple legislative and licensing issues. Our Texas Continuing Education course is state-approved by the TDLR. Finish in less than 12 hours.

This 12 Hour Online course meets all TDLR requirements for Property Tax Consultants to renew their license in Texas. Property Tax Consultant and Senior Property Tax Consultant registration must be renewed annually with TDLR. Especially Auctioneers Air Conditioning and Refrigeration Contractors Cosmetologists Electricians Property Tax Consultants Towing Operators Well Driller and Pump Installers.

We offer Texas Protax property tax consulting services for businesses and homeowners alike. You will take a 40-hour pre-licensing class and need to pass the Texas State Exam to get licensed as a Property Tax Consultant. Are you ready to renew your Texas Property Tax Consultant License.

The Texas Department of Licensing Regulations requires that all PROPERTY TAX consultants complete 12 hours of continuing education. The course covers tax appraisal guidelines and requirements as well as best practices and useful business information. In 1988 the Texas Association of Property Tax Professionals TAPTP was formed to unite professionals involved in all aspects of property tax management within the state of Texas.

John Hirschy holds the following licenses in the state of Texas. Since property tax appeals often involve the judicial process at some point most property tax consultants have affiliations with lawyers who will represent the client should the. Income Approach to Valuation.

TX PROPERTY TAX CE Requirements. Texas State Certified General Real Estate Appraiser License 1320470-G. MAI SRA in the Appraisal Institute since 1985 North Texas President 2004 460 members.

Ad Call The Experts Today For A Speedy Answer To Your Property Tax Loan Questions. Credits reported to TDLR within 24 Hours of completion. The Comptrollers office is required to approve content of certification examinations for property tax professionals Occupations Code Section 11511015.

If NO you must be sponsored by a senior property tax consultant or Texas Attorney. 1 be a registered senior property tax consultant. Texas Laws and Rules are also covered.

This 24 Hour Online course meets all TDLR requirements for Property Tax Consultants to renew their license in Texas. Completing your Texas Cosmetology License. Fundamentals of Real Property Appraisal.

Frequently Asked Questions Texas Property Tax Consultants Inc

Real Property Tax Assessment Appeal Services Altus Group

Commercial Property Tax Professionals

About Optc Ortiz Property Tax Consulting

22 762 Property Tax Photos Free Royalty Free Stock Photos From Dreamstime

Karen Milan Cantrell Mcculloch Inc Dallas Property Tax Consultants

Property Tax Consultant Wins Watchdog S Appraisal Appeal Shows Texas System Still Unfair

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/Z5V56U3APBZQ2IAXABSMR5IK4E.jpg)

Property Tax Consultant Wins Watchdog S Appraisal Appeal Shows Texas System Still Unfair

Real Property Tax Assessment Appeal Services Altus Group

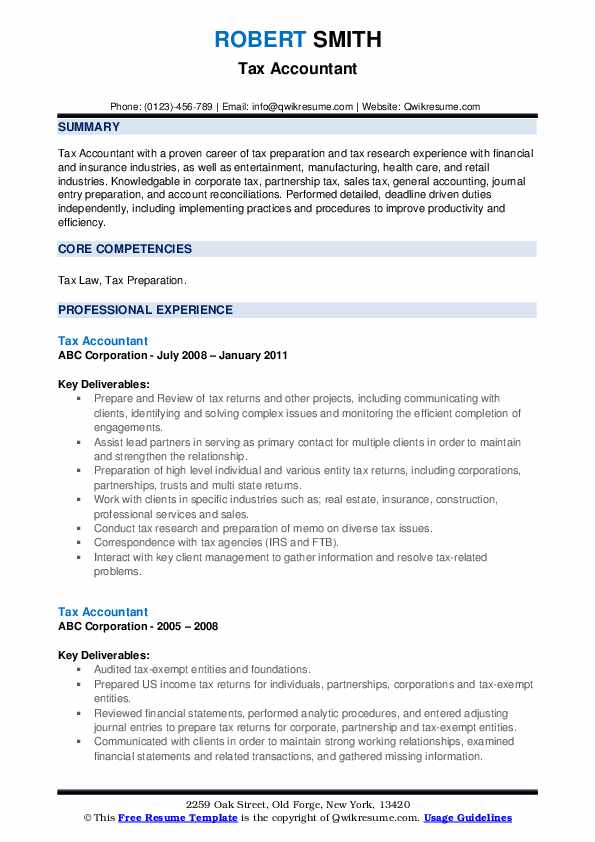

Tax Accountant Resume Samples Qwikresume

22 762 Property Tax Photos Free Royalty Free Stock Photos From Dreamstime

Harding And Carbone Crunchbase Company Profile Funding

How To Become A Tax Consultant

About Lower My Texas Property Taxes

About Optc Ortiz Property Tax Consulting

Do You Need A Property Tax Attorney Or Consultant Propertytaxes Law